Introduction

Drone Statistics: In recent years, Drones have made a clear mark as essential tools across many industries in 2025. The installed base of commercial drones rose to an impressive 2.8 million units worldwide in 2024, with strong adoption expected to continue this year. These devices operate not only in agriculture, public safety, and infrastructure inspection but also in new fields like logistics, environmental monitoring, and media, underscoring just how versatile drone technology has become. Usage patterns are shifting rapidly as industries prioritize efficiency and safety.

For example, drones are now key in surveying, project monitoring, and safety checks at construction sites, helping teams get precise updates and identify potential risks early. In agriculture, drones see demand for both aerial crop imagery and spraying, offering farmers a way to improve yields and better manage their fields. In public safety and emergency response, drones enable fast access to real-time images and support critical operations, from rescue efforts to infrastructure assessments.

If you are interested in gaining a deeper understanding of the drone industry and its diverse segments, then exploring drone statistics will be highly valuable. These statistics provide insights into adoption rates, technological advancements, regulatory developments, and regional performance. By analyzing such data, industry stakeholders can better assess market trends, identify high-growth applications, and evaluate investment opportunities.

Drone Statistics (Top Editor’s Choice)

- Drone Market size is expected to be worth around USD 95.4 Billion by 2034, from USD 36.4 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034.

- 853,857 drones are registered in the United States.

- You must register a drone over 0.55 pounds.

- 270,183 people have their remote pilot certification.

- In 2025, over 2,679,000 commercial drones are expected to be in operation worldwide.

- The drone workforce includes around 2.1 million people globally, with more than 33,000 registered drone companies. In the past year alone, over 126,000 new jobs have been added in the sector

- Global drone revenue is expected to grow to $63.6 billion by 2025.

- Goldman Sachs, Baidu, Rise Fund, and more have invested substantial amounts, totaling over USD 1 billion.

- Most countries now require drones over 250 grams to be registered.

- The drone industry has received substantial investment, with an average of USD 27.2 million per funding round. Over 2000 investors have participated in more than 7000 funding rounds.

- The drone sector has received over 29 000 patents and more than 6000 grants, demonstrating its dedication to research and development.

- As of 2024, the Federal Aviation Administration (FAA) in the United States registered 855,860 drones, with 96% of these owned by men and only 4% by women.

- The drone services market is set to reach USD 63.6 billion globally by 2025, reflecting the expanding use of drones in various sectors.

- DJI continues to dominate the drone manufacturing industry, holding 79% of the market share in 2023, with 54% of the global market share and 80% in the US market by 2024.

- Global drone shipments reached 2.4 million units in 2023, with expectations to surpass 3.1 million units annually by the end of 2025.

- In 2023, China led the world in drone revenue generation, contributing USD 1,526 million to the global market.

You May Also Like To Read

Ownership Statistics

- Drone Ownership Rate: About 8% of Americans own a drone, reflecting growing consumer interest in recreational and professional drone use.

- Largest Demographic: The 45-54 age group represents the largest segment, accounting for 22% of U.S. drone owners.

- Second Largest Group: The 35-44 age group holds 20% of drone ownership, showing strong adoption among mid-career professionals.

- Third Largest Group: The 25-34 age group accounts for 17% of drone owners, driven by younger adults using drones for photography, videography, and hobbyist purposes.

- Smallest Demographic: Individuals 65 and older represent just 6% of drone owners, indicating limited adoption among older generations.

(Credit:dronesdirect.co.uk)

Funding Landscape of the Drone Industry

More than 2000 investors have been involved in over 7000 funding rounds, reflecting a strong and supportive ecosystem that continues to drive both startups and established companies in the drone industry. In addition, more than 3000 companies have successfully secured investments, which illustrates the breadth of innovation and entrepreneurial activity shaping the sector. This investment momentum not only demonstrates the financial stability of the drone industry but also underlines its growing importance in advancing technology and contributing to global economic development.

(Credit:startus-insights)

Investing in the Drone Industry

(Credit:startus-insights)

Major Investors in Drone Technology

| Investor | Investment Amount (USD) | Number of Companies | Notable Investments |

|---|---|---|---|

| Goldman Sachs | 363.5 million | 2 | – |

| Baidu | 343.6 million | 3 | 182.2 million in XAG (agricultural drones) |

| The Rise Fund | 244.5 million | 2 | – |

| General Atlantic | 219.8 million | 3 | – |

| U.S. Department of Defense | 2 billion | 17 | 250 million in Anduril Industries (Roadrunner drones) |

| Drone Fund | 6.3 million | 10 | 6.2 million in Marut Drones |

| BPI France | 41.3 million | 9 | Acquisition of MC2 Technologies (with Andera Partners) |

| TransDigm | 150 million | 2 | – |

| Accel | 133.6 million | 4 | – |

| Intel Capital | 128.8 million | 4 | – |

(source:startus-insights)

Drone Usage Statistics

- Recreational Registrations: About 63% of drone registrations (536,183 units) were for recreational purposes, showing the strong hobbyist demand in the U.S.

- Commercial Registrations: Around 37% of registrations (316,075 units) were tied to commercial operations, reflecting the professionalization of drone applications across industries.

- Top Commercial Use Cases: The agriculture industry represents the largest commercial market for drones, followed by construction and infrastructure. These sectors rely on drones for crop monitoring, surveying, and site inspections.

- Military Use: According to the U.S. Department of Defense, the Pentagon currently operates more than 11,000 unmanned aerial systems (UAS). These are deployed in both domestic training exercises and overseas contingency missions, underscoring their importance in national defense.

Drone Market Size

The global drone market is on a steady growth path, expanding from USD 36.4 billion in 2024 to an anticipated USD 95.4 billion by 2034, advancing at a compound annual growth rate of 10.1% during the period from 2025 to 2034. This growth reflects the increasing reliance on drones across diverse sectors, including defense, agriculture, logistics, construction, and surveillance. Continuous improvements in autonomous navigation, AI-powered flight systems, and real-time imaging are making drones more versatile and efficient.

(Source – Market.us)

Key Insights Summary

- Market Leadership: DJI remains the undisputed leader, controlling about 80% of the U.S. market and 60% of the global market, reinforcing its position as the largest drone manufacturer worldwide.

- Industry Spending: Businesses and government agencies together spent $13 billion on drones, reflecting their growing adoption across commercial, defense, and public service applications.

- Regulatory Landscape: The FAA registered 855,860 drones in the U.S. by 2024. Of these, 270,183 individuals have earned their remote pilot certification, highlighting compliance and readiness for commercial use.

- Demographics: Drone ownership in the U.S. is highly skewed, with 96% male operators compared to 4% female operators, underscoring a significant gender gap in drone usage.

- Employment Impact: By 2025, the drone sector is projected to create over 103,000 jobs, pointing to its growing role as a contributor to workforce expansion.

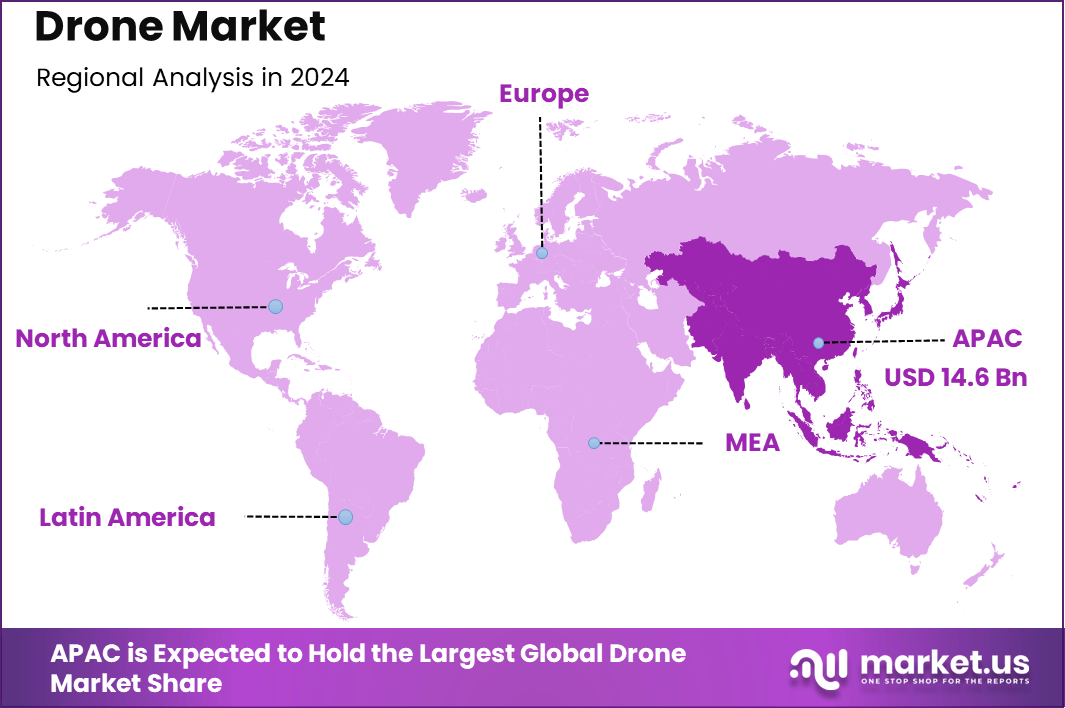

- Regional Share: The APAC region captured 40.2% of global revenue in 2024, amounting to USD 14.63 billion. Strong adoption in China, Japan, and India for both military and commercial use fueled this growth.

- Product Type: The Rotary Wing Drone segment dominated with 61.1% share in 2024 due to its versatility in surveillance, delivery, and mapping applications. Meanwhile, Fixed-Wing Drones rose from 31.7% in 2019 to 38.9% in 2024, showing growing acceptance in long-range and endurance-focused operations.

- Application Share: The Military segment led with 48.8% share in 2024, driven by defense investments in drones for intelligence gathering, border control, and combat operations.

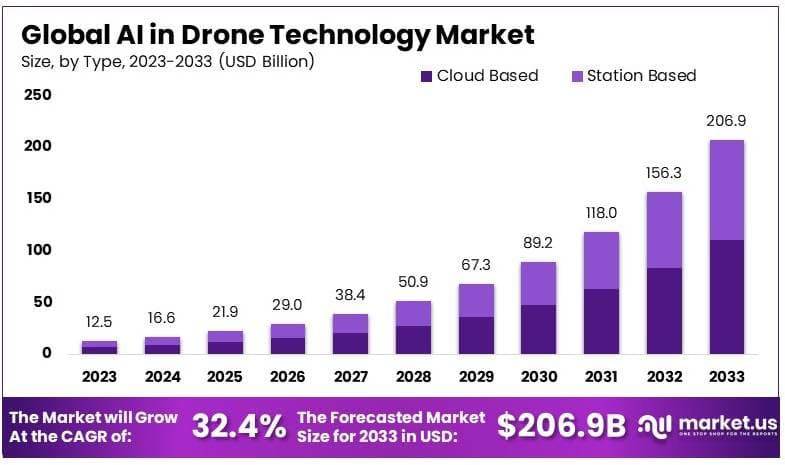

AI in Drone Technology Market Statistics

- The market was valued at USD 12.5 Billion in 2023.

- It is expected to reach USD 206.9 Billion by 2033.

- This growth reflects a strong CAGR of 32.4%.

- Cloud-Based solutions led the type segment in 2023 with 53.4% share, driven by flexibility in managing and analyzing drone data remotely.

- Military & Defense dominated the application segment, capturing 38.2% share, due to the role of AI in enhancing surveillance, navigation, and autonomous drone capabilities.

- North America led the market in 2023, accounting for 36.2% share, supported by strong defense investments and advanced adoption of drone technology.

(Source- market.us)

Drone Market Share

By Type Analysis, 2019-2024 (%)

| Type | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Fixed-Wing Drone | 31.7% | 33.1% | 34.6% | 36.0% | 37.7% | 38.9% |

| Rotary Wing Drone | 68.3% | 66.9% | 65.4% | 64.0% | 62.3% | 61.1% |

By Application Analysis, 2019-2024 (%)

| Application | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Consumer | 16.6% | 16.4% | 16.3% | 16.1% | 15.9% | 15.7% |

| Commercial | 34.3% | 34.6% | 34.8% | 35.0% | 35.3% | 35.5% |

| Construction | 55.2% | 55.5% | 55.8% | 56.1% | 56.6% | 56.7% |

| Agriculture | 7.8% | 8.0% | 8.1% | 8.2% | 8.4% | 8.5% |

| Oil & Gas | 5.9% | 5.8% | 5.7% | 5.6% | 5.5% | 5.3% |

| Mining | 3.1% | 3.0% | 2.9% | 2.8% | 2.8% | 2.7% |

| Public Safety & Law Enforcement | 15.5% | 15.4% | 15.3% | 15.2% | 15.0% | 15.1% |

| Others | 12.5% | 12.3% | 12.2% | 12.0% | 11.7% | 11.7% |

| Military | 49.1% | 49.0% | 48.9% | 48.9% | 48.8% | 48.8% |

Regional Highlights: A Global Perspective

In 2024, the Asia-Pacific region secured a dominant position, accounting for more than 40.2% of the global market share and generating USD 14.63 billion in revenue. This leadership is supported by large-scale investments in drone technology, rising demand for drones in agriculture and security operations, and proactive government initiatives to foster innovation. Countries within the region are utilizing drones for disaster management, smart city development, and cross-border surveillance, strengthening their role in both public and private sectors.

(Source- market.us)

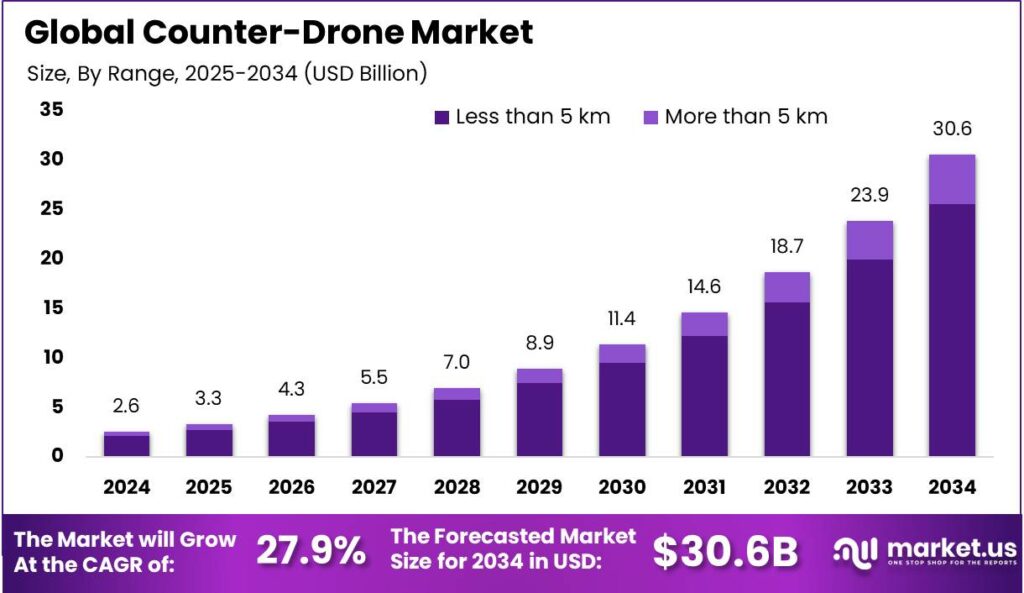

Counter-Drone Market Statistics

- The market is expected to reach USD 30.6 Billion by 2034, up from USD 2.61 Billion in 2024.

- Growth will occur at a CAGR of 27.9% during 2025–2034.

- North America led in 2024 with a 43.7% share, valued at USD 1.14 Billion.

- The U.S. accounted for USD 1.02 Billion, showing a 26.7% CAGR.

- The Hardware segment dominated with 69.2% share in 2024.

- Ground-Based systems led with 76.8% share.

- The Less than 5 km range segment held 83.7% share.

- Anti-Drone Radar technology captured 56.1% share.

- Destructive Systems dominated with 82.6% share.

- Drone Detection & Disruption Systems held 78.4% share.

- Military & Defense was the largest end-user, at 61.8% share.

- North America continues to dominate with high defense spending and infrastructure security needs.

- The U.S. remains the most strategic market due to military modernization and homeland security focus.

(Source- market.us)

Consumer Drone Market Statistics

- The market is projected to reach USD 12.4 Billion by 2033, up from USD 5.4 Billion in 2023.

- The growth rate is expected at a CAGR of 8.7% between 2024 and 2033.

- In 2023, the Multi-rotor product type led with 68% share.

- The Toy/Hobbyist application segment dominated with 63.5% share.

- Asia Pacific led regionally, holding 41% share worth USD 2.21 Billion in 2023.

(Source- market.us)

Passenger Drones Market Statistics

- The market was valued at USD 0.6 Billion in 2023.

- It is projected to reach USD 7.7 Billion by 2033.

- The growth rate is expected at a CAGR of 29.1%.

- In 2023, the Above 100 KG capacity segment led with 81.9% share, due to higher payload capacity.

- The Commercial end-use segment dominated with 78.5% share, supported by rising demand for drone-based services.

- Asia-Pacific was the leading region, holding 45.0% share in 2023, reflecting strong adoption and investment.

(Source- market.us)

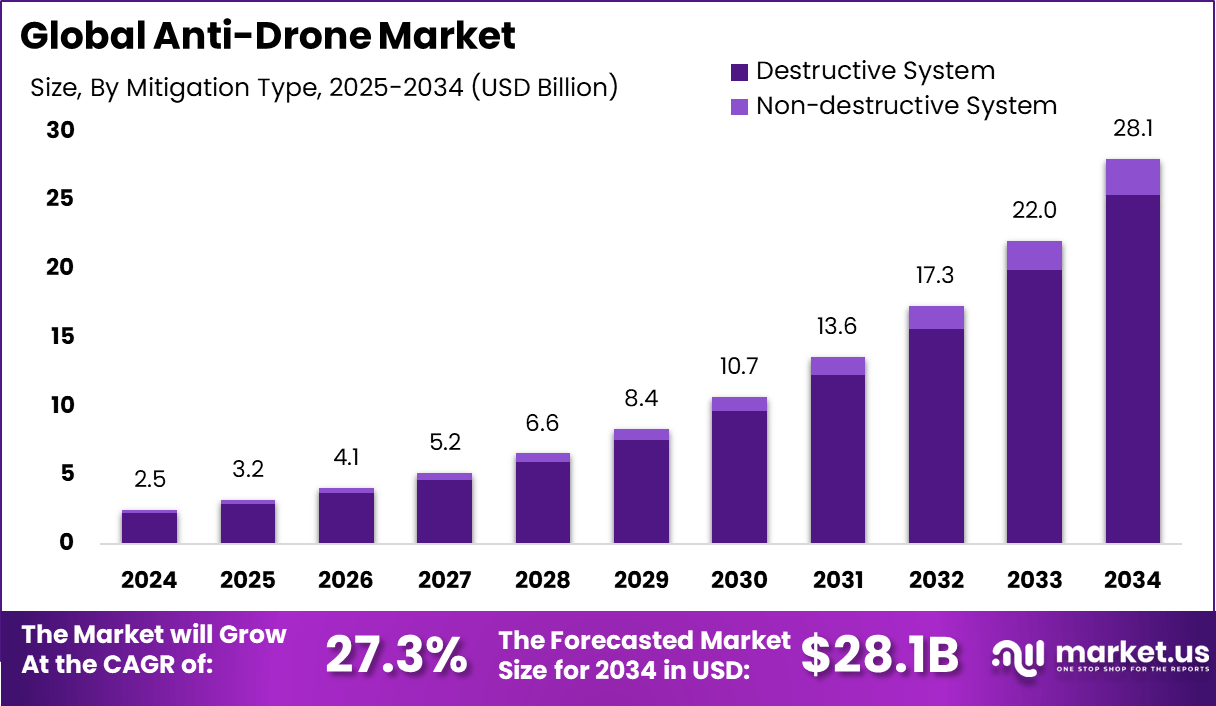

Anti-Drone Market Statistics

- The market is projected to grow from USD 2.5 Billion in 2024 to USD 28.1 Billion by 2034.

- The expected growth rate is a CAGR of 27.3%.

- North America led in 2024, holding 46.8% share, valued at around USD 1.1 Billion.

- The U.S. market alone stood at USD 0.74 Billion and is projected to grow at a CAGR of 27.5%.

- The Destructive System segment dominated, with over 90.7% share, showing strong adoption of physical neutralization.

- Drone Detection & Disruption Systems captured 69.7%, highlighting their deployment as integrated defense solutions.

- Radar-Based Detection was the leading detection technology in 2024, preferred for wide-area and complex surveillance.

- The Electronic Systems segment held the largest share in technologies, driven by jamming and signal disruption.

- Ground-based platforms led in 2024, due to scalability and ease of deployment in strategic and border zones.

- The Military & Defense sector dominated, holding 58.9% share, reflecting growing demand for national security applications.

(Source- market.us)

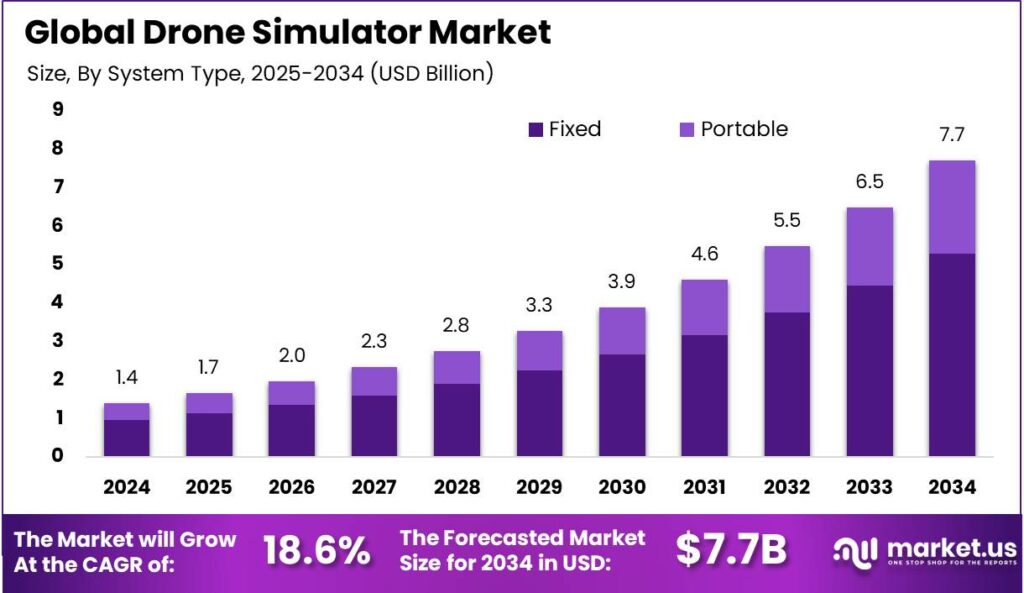

Drone Simulator Market Statistics

- The market is projected to reach USD 7.7 Billion by 2034, rising from USD 1.4 Billion in 2024.

- Growth will occur at a CAGR of 18.6% between 2025 and 2034.

- In 2024, the Commercial segment led with 54.7% share.

- The Fixed segment dominated by system type, holding 68.7% share.

- The Hardware segment led by component, capturing 58.6% share.

- Fixed Wing simulators dominated by drone type, with 70.2% share.

- The Augmented Reality (AR) device type held the top position with 65.5% share.

- North America led regionally, securing 36.5% share worth USD 0.51 Billion in 2024.

- The U.S. market reached USD 0.43 Billion in 2024 and is projected to grow at a 16.7% CAGR.

- Growth is driven by applications in training, defense preparedness, commercial pilot education, and mission planning.

(Source- market.us)

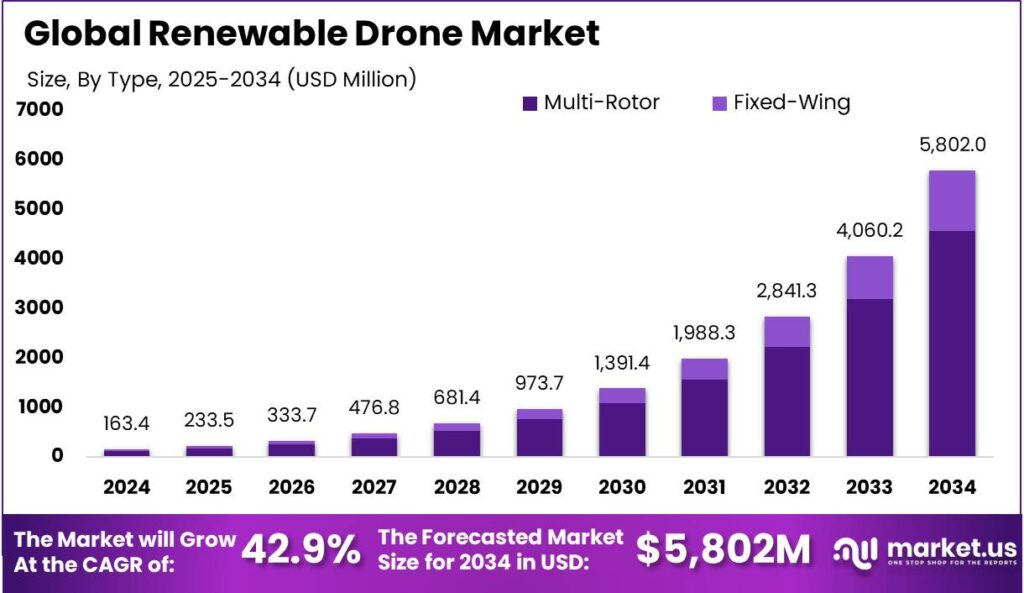

Renewable Drone Market Statistics

- The market is expected to grow from USD 163.4 Million in 2024 to USD 5,802 Million by 2034.

- This represents a strong CAGR of 42.90% during 2025–2034.

- The Multi-Rotor segment dominated in 2024, capturing 78.7% share of the global market.

- The Solar segment held the lead in 2024, accounting for 82.7% share of the market.

- By payload, the 5–15 kg segment led in 2024, with a share of 38.4%.

- By range, the 50 km segment dominated, securing 41.9% share.

- The Aerial Surveying and Mapping segment captured 41.3% share of the global market in 2024.

- North America led in 2024, holding 42.7% share and generating USD 69.7 Million in revenue.

- The U.S. market was valued at USD 62.79 Million in 2024, with a projected CAGR of 39.6%, driven by adoption of sustainable UAV systems.

(Source- market.us)

Drone Incident Statistics

- Around 4,250 drone injuries were reported between 2015 and 2020.

- 21% of injuries occurred in individuals under 18.

- Multirotor drones caused more than 70% of reported incidents.

- 75% of incidents happened between 10 a.m. and 10 p.m., while 25% occurred overnight.

- 84% of injured patients were male, compared to 16% female.

- Fingers were the most commonly injured body part, making up 56% of cases.

- Drone smuggling incidents rose by 38% in 2023.

- Along the India-Pakistan border, 84% of smuggling incidents occurred, followed by 12% at the Jordan-Syria border and 4% at the Israel-Lebanon border.

- 28% of drone incidents were linked to smuggling illegal items and drugs into prisons.

- 18% of incidents involved drone-related dangers and disruptions at airports in the U.S., India, Israel, and the U.K.

Benefits

- Drones improve operational efficiency by quickly gathering real-time data.

- They reduce workplace risks by taking over dangerous tasks such as inspections in hard-to-reach areas.

- Drones cut costs and save time by automating repetitive activities like surveying and monitoring.

- They aid environmental efforts through detailed aerial monitoring in remote or sensitive locations.

- Drones enhance precision in agriculture, allowing targeted spraying and better resource management.

Attractive Opportunities

- The agriculture sector uses drones for crop health monitoring, soil analysis, and precise spraying.

- Construction and infrastructure rely on drones for project tracking, safety checks, and site inspections.

- Security and surveillance benefit from drones’ ability to cover large areas with minimal human intervention.

- Logistics companies explore drones for faster and more efficient last-mile delivery solutions.

- Creative industries such as media, real estate, and events use drones for innovative aerial photography and videography.

Major Challenges

- Unclear and evolving regulations create delays in drone certification and restrict full operational capabilities.

- A shortage of trained drone pilots and technical professionals limits industry growth and innovation.

- Drone cybersecurity vulnerabilities pose risks of hacking, GPS interference, and data theft.

- Safety incidents caused by drone malfunctions or collisions remain a concern for operators and the public.

- Privacy concerns arise from the potential misuse of drones for unauthorized surveillance and data collection.

Conclusion

Drones offer clear benefits and exciting prospects across multiple industries by increasing efficiency, enhancing safety, and providing valuable data insights. However, to fully leverage their potential, challenges around regulation, skills, security, safety, and privacy must be addressed carefully. The balance between innovation and responsible use will shape how drones integrate into business and daily life in the coming years.

Sources:

- https://skykam.co.uk/drone-statistics/

- https://www.startus-insights.com/innovators-guide/drone-report/

- https://www.dronesdirect.co.uk/files/pdf/dronesreport.pdf

- https://coolest-gadgets.com/drones-statistics/

- https://opticsmag.com/drone-statistics/