Executive Summary

The global retail industry in 2025 is valued at around $35.2 trillion, growing steadily at a CAGR of 7.65% over recent years and expected to reach about $50.8 trillion by 2030. This growth is supported by a shift in consumer shopping behaviors that blend online and in-store experiences, reflecting an omnichannel retail environment.

In the United States alone, retail accounts for 55 million jobs and approximately 4.6 million retail establishments operate nationwide. Emerging markets, especially in Asia and the Gulf region, are contributing substantially to this growth, driven by larger urban populations and digital adoption.

This year also reveals how retailers retool their operations to enhance customer experience through technology, optimize costs, and respond to economic uncertainties. Despite inflationary and supply chain pressures, the industry shows resilience, with many companies reporting improvements in net profit margins and revenue. The combination of innovation, agility in financial management, and entering new market segments define major competitive advantages in 2025.

Advancements drive engagement

In 2025, 87% of retailers globally have integrated artificial intelligence (AI) into various operations, such as customer service, demand forecasting, and personalized marketing. AI-powered chatbots and virtual assistants improve customer engagement, with 70% of retail executives expecting AI to significantly personalize customer experiences in the current year. The use of augmented reality (AR) for product trials and immersive shopping experiences has increased conversion rates by up to 20% in fashion and electronics sectors.

Social commerce is a vital driver, accounting for nearly 13% of online retail sales worldwide as customers increasingly shop directly on platforms like Instagram, TikTok, and Facebook. Loyalty programs enhanced with gamification and real-time rewards have boosted repeat purchase rates by 40% for leading retailers in the U.S. Retailers also invest in mobile commerce technologies, with mobile sales projected to reach $4.5 trillion globally, reflecting a shift toward convenience and mobile-first shopping habits.

AI-based Marketing Initiatives

AI is significantly used across many marketing activities in 2025, transforming how brands connect with customers and optimize their campaigns. One of the primary areas is personalization, where AI analyzes customer data and behavior in real time, allowing marketers to create highly tailored experiences that adapt instantly to user preferences. This means emails, website content, and even product recommendations can shift dynamically to match what the customer is most likely to engage with at any moment. Predictive analytics is another vital application, helping marketers forecast customer actions such as purchase likelihood and churn risk, which improves targeting and customer retention efforts.

AI-powered chatbots and virtual assistants have become standard tools especially for customer engagement and support, providing instant responses and personalized product suggestions. Dynamic pricing is also prominent, where AI adjusts prices in real time based on demand, competitor activity, or other influencing factors, optimizing revenue without manual intervention. Content creation benefits too, with AI generating marketing copy, social media posts, and even ads, streamlining the creative process while maintaining relevance.

Key Marketing Activities

- Customer Segmentation & Targeting – AI analyzes customer data to create precise audience segments.

- Personalized Marketing – AI tailors product recommendations, emails, and ads to individual users.

- Predictive Analytics – Forecasts customer behavior, churn, and lifetime value.

- Content Creation & Optimization – AI generates ad copy, blogs, product descriptions, and optimizes SEO.

- Chatbots & Virtual Assistants – Automates customer support, lead nurturing, and FAQs.

- Programmatic Advertising – Real-time AI bidding and ad placement for maximum ROI.

- Email Marketing Optimization – AI decides best send times, subject lines, and personalization.

- Social Media Listening & Insights – AI tracks trends, brand mentions, and sentiment analysis.

- Visual Recognition in Marketing – AI scans images/videos for brand logos, product placement, and trend detection.

- Customer Journey Mapping – AI predicts and improves every touchpoint in the buyer’s journey.

- Dynamic Pricing & Promotions – AI adjusts prices and discounts based on demand, competition, and user behavior.

- Voice Search Optimization – Adapts content for AI-powered voice assistants.

Financial insights

Globally, retail sales are forecast to reach $32.4 trillion in 2025, driven largely by e-commerce, which now totals about 16.4% of all retail sales in the U.S. alone. The U.S. retail market is valued at $7.4 trillion, showing a steady annual growth rate of 2.2%. Leading companies like Reliance Retail in India reported consolidated revenues of ₹330,870 crore (approximately $41 billion) in FY25, with EBITDA margins improving to 8.6%, representing a 7.9% growth year-over-year.

Despite external pressures such as fluctuating raw material costs and tariff hikes, many retailers are optimizing cost structures and improving efficiencies. Profit after tax for top Indian retail companies grew by 29.1% in FY25. Retail digital advertising spends, inventory management improvements, and customer data utilization combined have resulted in about 20% faster inventory turnover for top companies globally. These financial metrics underline the sector’s resilience and potential profitability despite macroeconomic slowdowns.

Market Size and Growth

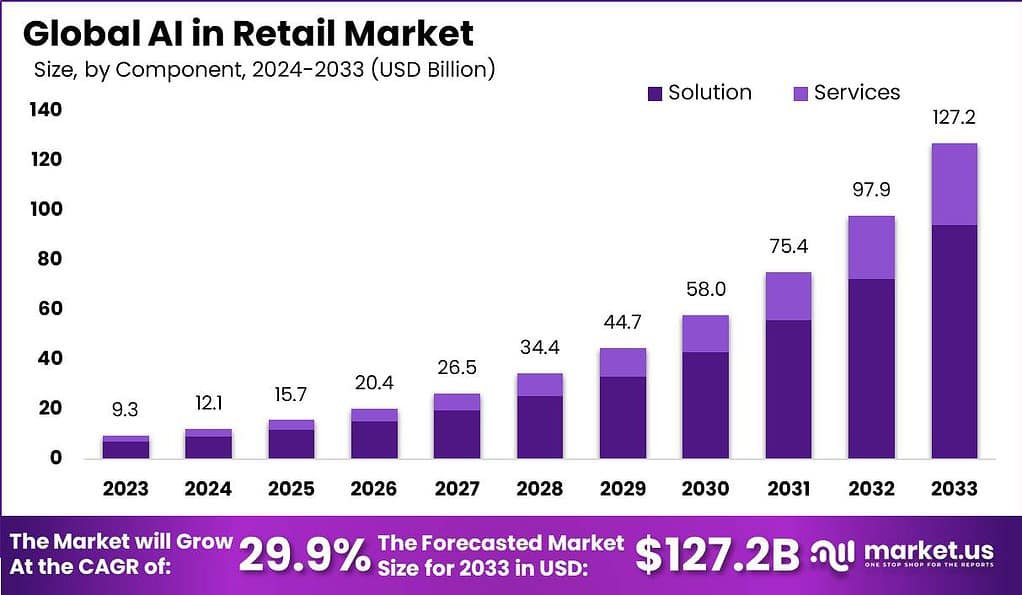

- The Global AI in Retail Market is expanding rapidly as retailers adopt advanced technologies to improve personalization, supply chain efficiency, and customer engagement. Valued at USD 9.3 Billion in 2023, the market is projected to reach nearly USD 127.2 Billion by 2033, advancing at a CAGR of 29.9% between 2024 and 2033.

- By Component, the Solution segment dominated with a 74.1% share, reflecting high adoption of AI-powered retail platforms.

- By Technology, Machine Learning led with a 37% share, supporting personalized recommendations, demand forecasting, and automation.

- By Application, Customer Relationship Management (CRM) held 22.7% share, highlighting AI’s role in customer engagement and loyalty management.

- By Retail Format, Omni-Channel Retailers commanded a 44.2% share, showing how AI enhances cross-channel experiences.

- By Region, North America led with a 39.3% share, supported by advanced digital infrastructure and retail innovation.

(Source: market.us)

Retail Banking Industry Statistics

- The Global Retail Banking Market is witnessing steady expansion as digital transformation, evolving customer expectations, and regulatory support reshape the sector. Valued at USD 1,984.7 Billion in 2023, the market is projected to reach nearly USD 3,554 Billion by 2033, recording a CAGR of 6.0% from 2024 to 2033.

- By Bank Type, Private Sector Banks dominated with a 35.5% share, supported by their strong customer base and market presence.

- By Service Type, Transactional Services led with a 43.2% share, reflecting high demand for everyday banking operations.

- By Region, Asia-Pacific held 36.1% share in 2023, driven by its large banking population and strong economic growth.

(Source: market.us)

Predictive AI In Retail Statistics

- The market is projected to grow from USD 4.42 Billion in 2024 to USD 20.2 Billion by 2034.

- This reflects a strong CAGR of 16.4% during 2025–2034.

- By Component, the Solution segment dominated with a 59.2% share in 2024, driven by AI-powered predictive tools.

- By Application, Customer Experience Management (CEM) led with a 24.3% share, reflecting AI’s role in personalization and customer insights.

- By Retail Category, Groceries & Food held 21.2% share, supported by demand forecasting and inventory optimization.

- By Region, North America captured 34.1% share in 2024, generating about USD 1.5 Billion in revenue.

- The U.S. market was valued at USD 1.32 Billion in 2024 and is projected to grow at a CAGR of 15.8%, highlighting strong adoption in predictive retail analytics.

(Source: market.us)

Retail Digital Signage Statistics

- The market is projected to grow from USD 6.4 Billion in 2024 to USD 21.2 Billion by 2034.

- This reflects a healthy CAGR of 12.7% during 2025–2034.

- By Product Type, Video Walls led with a 27.3% share in 2024.

- By Component, the Hardware segment dominated with 53.7% share.

- By Display Technology, LED displays held the lead with 48.5% share.

- By Resolution, the 8K segment accounted for 34.7% share.

- By End-Use Sector, Fashion & Apparel led with a 28.9% share.

- By Location, the In-Store segment dominated with a 74.7% share.

- By Screen Size, Below 32 Inches displays held 58.5% share in 2024.

- By Region, North America captured 34.8% share, generating about USD 2.2 Billion in revenue.

- The U.S. market was valued at USD 1.78 Billion in 2024 and is expected to grow at a CAGR of 10.2%.

(Source: market.us)

Retail E-Commerce Statistics

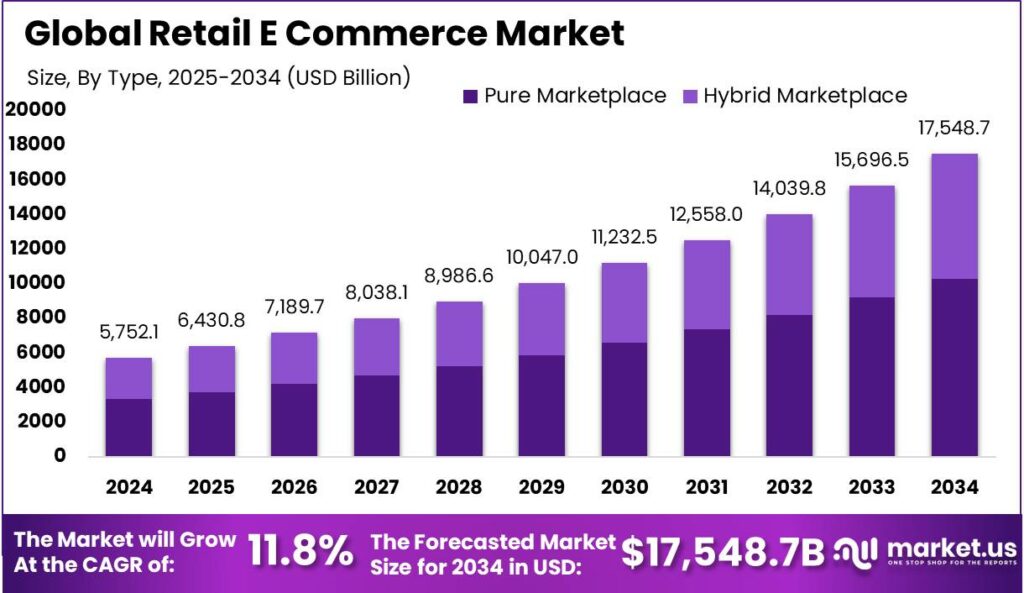

- The market is projected to grow from USD 5,752.1 Billion in 2024 to USD 17,548.7 Billion by 2034.

- This represents a strong CAGR of 11.8% during the forecast period.

- By Product Segment, Apparels & Accessories led with a 23.7% share in 2024, reflecting sustained demand in fashion retail.

- By Business Model, the B2B segment dominated with 63.6% share, showing the rise of wholesale and enterprise-driven online trade.

- By Platform Type, Pure Marketplaces held the largest share at 58.7%, supported by scalable models and wider product reach.

- By Region, North America accounted for 32.7% share, generating about USD 1,880.9 Billion in 2024.

- The U.S. market alone was valued at USD 1,692.8 Billion in 2024, underlining rapid digital transformation and online retail adoption.

(Source: market.us)

Industry dynamics

The retail industry in 2025 emphasizes omnichannel presence, enabling customers to shop online, pick up in-store, or return products hassle-free. Physical retail is evolving to offer more immersive and experiential interactions, resulting in an 18% increase in in-store sales for companies employing retailtainment strategies. The sector is also moving toward sustainability, with about 60% of retailers adopting eco-friendly packaging and sustainable supply chain policies to meet rising consumer demand for responsible brands.

Automation and digital tools have accelerated frontline operations, with task speed and accuracy improving by 30%, reducing labor costs and improving customer service. Workforce skill requirements are evolving, with employee upskilling in tech and data analytics becoming critical. In response to inflation and economic pressures, many retailers are shifting focus from aggressive pricing to value-added services and brand trust.

Mergers and acquisitions

The retail sector witnessed a rise of 12% in global M&A activity compared to the previous year, with North America seeing an 11% increase in deal volume. Large-scale acquisitions have been noted in grocery chains, fast fashion, and technology-driven retail firms aiming to scale and access new customer bases effectively. Strategic acquisitions of startups specializing in AI, data analytics, and e-commerce platforms are notable, reshaping the competitive landscape.

Early 2025 showed retail deals growing by 20% in the Americas, focusing on reinforcing supply chain capabilities, loyalty program integration, and digital transformation. Regional players are also merging to challenge global giants, pushing the sector toward consolidation and operational efficiencies. These acquisitions frequently drive innovation by blending new technology and traditional retail strengths.

Recent Developments

- Wacoal’s acquisition of Bravissimo in September 2024 marked an important step for Wacoal, a Japanese lingerie manufacturer, to expand its growth opportunities and optimize its supply chain. Bravissimo’s strong presence in the UK lingerie market made this a strategic move to capture larger market share in niche segments. (Wacoal, 2024)

- The Foschini Group (TFG) acquired UK-based fashion brand White Stuff in October 2024. This acquisition gave TFG access to White Stuff’s established customer base and broadened its portfolio of high-street fashion brands. (The Foschini Group, 2024)

- In November 2024, the online floristry segment witnessed consolidation as Euroflorist’s subsidiary Flowers Online acquired Serenata Flowers, a UK-focused online retailer. At the same time, Prestige Flowers merged with Flowerline, a flower procurement and distribution company, showing increasing investor interest in e-commerce floristry. (Euroflorist & Prestige Flowers, 2024)

- Home Depot’s acquisition of SRS Distribution for $18.25 billion in June 2024 was one of the largest retail deals, aimed at expanding Home Depot’s supply chain capabilities and addressing complex project purchase needs in the residential professional market. (Home Depot, 2024)

Trends

A notable trend is the transformation of stores into experiential spaces, known as retailtainment, where shopping becomes a family or social activity enriched with events, workshops, and interactive engagements. This shift aims to build customer loyalty by making shopping more enjoyable and immersive. Alongside this, technological innovations like electronic shelf labels, RFID, and smart shelves are helping retailers optimize inventory management and dynamic pricing, contributing to operational agility.

Key trends shaping 2025 retail include hyper-personalization, where 70% of online shoppers report more purchases when offered tailored recommendations. The resale market is booming with annual growth rates exceeding 25%, fueled by sustainability concerns and economic factors. Direct-to-consumer (DTC) brands continue to capture market share by cutting out middlemen and enhancing customer relations.

Experiential retail formats like pop-ups and virtual showrooms have increased consumer engagement times by 30% over conventional stores. Discount and value retailers are benefiting as consumers seek affordability, shifting towards private label and promotional purchases. Mobile commerce is rapidly expanding, projected at a valuation of $4.5 trillion globally, reflecting digital adoption.

Omnichannel strategies continue to gain importance, ensuring a seamless and unified shopping experience across online, mobile, and physical stores, supported by improved data integration and advanced analytics. Sustainability also remains a key concern, with consumers seeking value-led, eco-conscious shopping options. Retailers are adopting technologies to promote transparent supply chains and sustainable inventory practices, though many shoppers are cautious about paying premiums for sustainability unless it aligns with convenience and quality.

Supply chain resilience is a critical focus, as global disruptions and geopolitical tensions still impact product availability and costs, prompting retailers to invest in real-time visibility and predictive analytics. Overall, the retail industry’s focus on customer-centric innovation, operational efficiency, and technology integration highlights a dynamic environment poised for significant transformations in 2025.

Technology outlook

Technology remains at the heart of retail transformation, with 87% of retailers deploying AI for customer service, inventory, and marketing efforts. Blockchain is increasingly used for supply chain transparency, assuring consumers of product authenticity and ethical sourcing. Cloud computing adoption improves data access, enabling real-time analytics that boost inventory turnover by up to 20% for leading retailers.

Cybersecurity investment has grown by 15% due to rising threats on customer data and transactions, with retailers focusing on multilayered protection across all sales channels. Automation tools improve operational efficiencies, while machine learning refines demand forecasts, helping retailers reduce overstocks and shortages. These technologies underpin greater agility and customer-centricity in 2025 retail.

Sources

- https://www.infosys.com/iki/research/retail-industry-outlook2025.html

- https://bizplanr.ai/blog/retail-industry-statistics

- https://www.mytotalretail.com/article/whats-driving-retail-ma-in-2025/

- https://kpmg.com/in/en/insights/2025/04/global-consumer-and-retail-m-n-a-outlook-2025.html

- https://www.tcs.com/what-we-do/industries/retail/white-paper/retail-trends-2025-future-of-shopping

- https://www.deloitte.com/global/en/Industries/retail/research/global-powers-of-retailing.html

- https://www.ibef.org/industry/retail-india

- https://www.ril.com/sites/default/files/2025-04/25042025_Media_Release_RIL_Q4_FY2024_25_Financial_and_Operational_Performance.pdf

- https://www.deloitte.com/us/en/insights/industry/retail-distribution/retail-distribution-industry-outlook.html

- https://www.alpha-sense.com/blog/trends/mergers-and-acquisitions-2024/

- https://professional.dce.harvard.edu/blog/ai-will-shape-the-future-of-marketing/