Introduction

Creator Economy statistics: The creator economy is an evolving online system where individuals create and share digital content, products, or services and directly earn money from their audience through various platforms. It involves over 207 million active content creators worldwide who produce original work in areas like social media, art, education, gaming, and much more.

Most of these creators connect with their followers on platforms such as YouTube, TikTok, Instagram, Twitch, and Patreon, allowing them to build personal brands and monetize their creativity or expertise. Despite its size and rapid growth, only about 4% of creators earn more than $100,000 a year, showing that while the creator economy is vast, professional success remains limited to a smaller group.

This economy is distinct because it removes traditional middlemen like major media companies, enabling anyone with digital tools and internet access to turn passion or skills into an income source. Creators make money through various means such as sponsorships, subscriptions, merchandise sales, donations, and advertising, fostering niche communities and diverse creative voices that were not possible before.

TLDR: Editor’s Choice

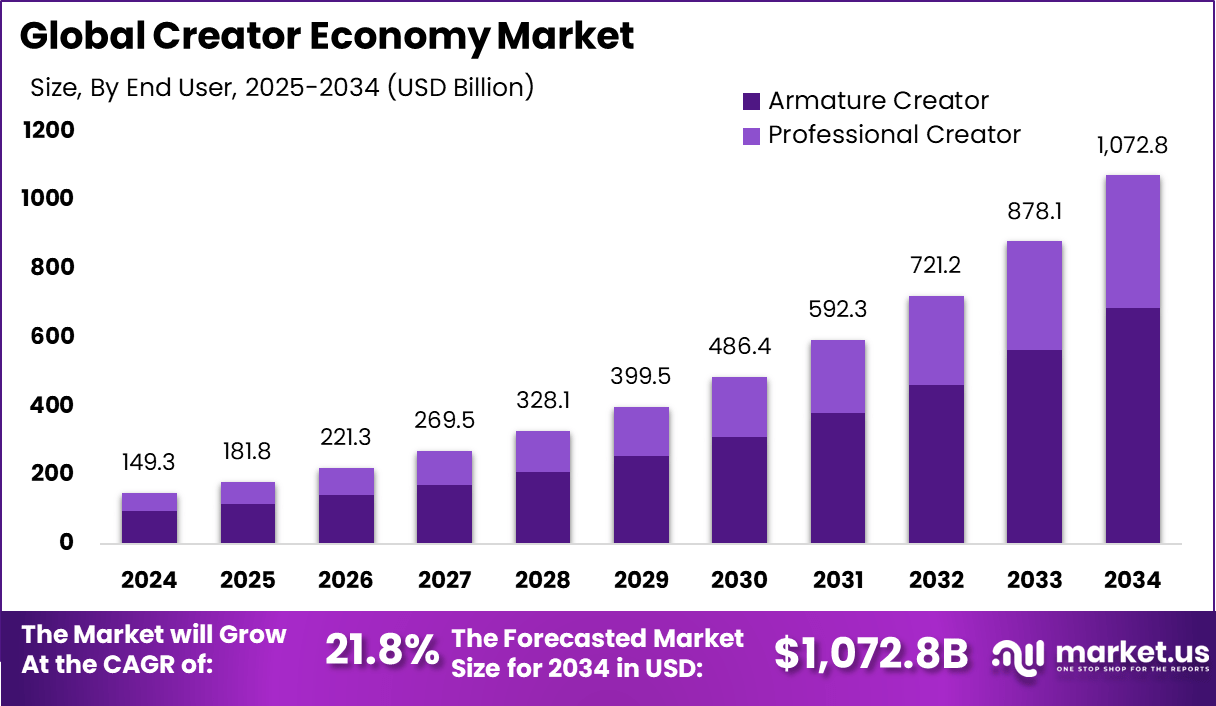

- The global creator economy is projected to rise from USD 149.4 billion in 2024 to USD 1,072.8 billion by 2034, at a 21.8% CAGR.

- Only 4%–10% of creators earn over USD 100K annually, showing that high-income professionals remain rare.

- YouTube, Instagram, and TikTok deliver the strongest ROI for brand campaigns.

- More than 91% of creators use generative AI to scale content output.

- Around 500 million people are active in the passion economy.

- 52% of creators are men, while 46.7% work full-time.

- Only 13% are Gen Z, and 67% have 1K–10K followers.

- Creators typically need 6.5 months to earn their first dollar.

- 70% spend 10 hours or fewer weekly producing content.

- Merchandise businesses generate over USD 500 million annually in this ecosystem.

- Shopify leads with USD 5.2 billion in creator economy revenues.

Historical Evolution

Early 2000s: Birth of Blogging

- The rise of blogging platforms like Blogger and WordPress allowed individuals to share personal and niche content online.

- Early monetization focused on ads, sponsorships, and affiliate links, but earning potential was limited.

Mid-2000s: Rise of YouTube

- YouTube launched in 2005, making video creation accessible globally.

- Introduction of AdSense (2007) and the Partner Program created the first scalable income streams for video creators.

Late 2000s: Social Media Growth

- Platforms like Facebook (opened wider in 2006) and Twitter (launched 2006) grew rapidly.

- The term “influencer” emerged as users built large followings and collaborated with brands for sponsored content and niche campaigns.

Early 2010s: Emergence of New Platforms

- Instagram (2010), Snapchat (2011), and TikTok’s predecessor apps (Musical.ly, 2014; TikTok global launch in 2018) enabled new content formats like stories and short-form video.

- The influencer marketing industry scaled significantly, with brands allocating budgets for digital personalities and micro-influencers.

Mid-2010s: Subscription Models

- Patreon launched in 2013, pioneering fan-based subscription models.

- Creators gained stable recurring income directly from supporters, moving beyond ad-based revenue.

Late 2010s: Expansion of Tools & Platforms

- Numerous platforms (Twitch, Ko-fi, Substack, OnlyFans) democratized earning methods, adding live streaming, tipping, eCommerce, and exclusive content.

- Startup activity surged in the “creator tech” ecosystem, providing analytics, collaboration, and rights management tools.

2020s: Mainstreaming and Growth

- The COVID-19 pandemic accelerated online content consumption, boosting creator earnings and platform innovation.

- By 2021, the sector was valued at about $104 billion, with rapid growth in platform revenues, creator numbers, and investment.

- New features, integration of direct-to-fan commerce, and shifts to decentralized ownership (NFTs, DAOs) defined the era.

Google Trends

Interest over time

Interest by region

Platforms and Tools

(credit: grin.co)

Platform-specific creator stats

YouTube

- YouTube remains the largest platform for creators with over 64 million creators worldwide.

- Creators earn on average $18 per 1,000 views, receiving about 55% of ad revenue generated.

- YouTube’s global ad revenue was over $10.47 billion in Q4 2024.

- Mobile devices account for 63% of YouTube watch time.

- The most subscribed channel (MrBeast) has 424 million subscribers.

TikTok

- TikTok creators earn between $0.40 to $1.00 per 1,000 views under its Creator Rewards program.

- On average, TikTok creators earn about $131,874/year, but earnings vary widely with follower tiers.

- Nano (1K–10K followers): $25–$125 per post

- Micro (10K–50K): $30–$400 per post

- Mid-tier (50K–500K): $500–$5,000 per post

- Mega creators (1M+ followers) can earn $10,000+ per post

- Average TikTok users spend about 32 minutes per day on the app.

- Instagram has over 2 billion monthly active users, ranking as the third largest social media platform.

- Creator payment per post ranges:

- Nano influencers: $10–$100/post

- Micro influencers: $100–$500/post

- Macro influencers (500K+ followers): $5,000–$10,000+ per post

- Instagram is the top platform for brand partnerships, with 57% of all brand deals occurring there.

- Average daily Instagram usage is about 29 minutes.

Twitch

- Twitch has over 7.1 million active streaming channels and users watch over 58 million hours of content daily.

- Twitch Partners earn roughly 70% of subscription revenue under its Partner Plus program.

- Typical earnings per subscriber are about $2.50/month, with streamers earning $5,000 per month at 1,000 average viewers and scaling higher with audience size.

- Top streamer Ibai reportedly earns $185K–$233K per month from 93,000+ subscribers.

Patreon

- Patreon hosts around 279,000 active creators and has paid out over $3.5 billion to date.

- Average Patreon creators earn approximately $1,000/month, with podcasters alone earning $472 million in 2024 backed by 6.7 million paid subscriptions.

- Patreon monthly revenue from one-time purchases grew 4x in 2024, indicating growing monetization.

Uscreen (Video Creator Platform)

- Uscreen supports creators with full control of their content and earnings, popular with video educators and fitness content creators.

- Average content length is 27 minutes, with streaming and subscription features driving revenue.

- Average subscriber lifetime is 15 months, with mobile accounting for 48% of viewership.

- Fitness creators on Uscreen earn an average of $11,939 per month, spirituality creators $8,678, and yoga & wellness creators $8,291.

Creator Profile Statistics

- The creator economy includes over 45 million professional content creators worldwide.

- 51.9% of creators are women, while 48.1% are men, showing a nearly balanced gender distribution.

- There are more than 162 million amateur content creators contributing to the ecosystem.

- 46.7% identify as full-time creators, while 42.7% work as part-timers.

- 10.6% of creators treat content creation as a hobby.

- Only 0.96% of creators have over 1 million followers, highlighting how few reach influencer-level scale.

Creator Economy Market Size

- Social Media Platforms led with 27.8% share, making them the top base for audience building and engagement.

- Video Streaming Platforms followed with 24.5% share, supported by rising demand for long-form, high-quality content.

- Video content dominated with 23.8% share, showing strong consumer preference for visual storytelling.

- Music content held 18.3% share, driven by short-form audio, streaming, and independent artists.

- Brand Collaborations led monetization with 23.5% share, as brands sought authentic creator partnerships.

- Advertising revenue contributed 20.9%, remaining important though slightly behind direct deals.

- Amateur creators made up 64.1%, reflecting easy entry and side-hustle growth.

- Professional creators accounted for 35.9%, highlighting structured full-time content creation.

- The U.S. creator economy reached USD 50.9 billion, growing at a strong 19.3% CAGR.

- North America led with 37.4% share, supported by mature platforms, tools, and digital infrastructure.

(credit: market.us)

Content Creator Economy Statistics

- The Global Content Creator Economy Market is projected to expand from USD 117 Billion in 2024 to USD 1,143 Billion by 2034, registering a strong CAGR of 25.6%.

- The U.S. Content Creator Economy Market reached USD 35.31 Billion in 2024 and is expected to grow at a CAGR of 24.2%, supported by unique regional factors such as advanced digital infrastructure and high consumer engagement.

- By content type, Entertainment Content dominated in 2024, capturing 34.7% share, underscoring its central role in creator-led growth.

- North America led globally with 37.5% share and revenue of USD 43.8 Billion in 2024, reflecting its strong ecosystem of creators, platforms, and advertisers.

- Video-Based Platforms accounted for 29.5% share, highlighting their importance as the primary medium for content creation and monetization.

- By creator type, Influencers & Social Media Personalities dominated with a 38.8% share, demonstrating their critical role in shaping consumer behavior and brand partnerships.

(credit: market.us)

France Market Statistics

- The France Creator Economy Market is projected to grow from USD 6,833.1 million in 2024 to USD 62,127.3 million by 2034, registering an impressive CAGR of 24.7% between 2025 and 2034.

- In 2024, social media platforms dominated with a 47.9% share, establishing themselves as the primary growth driver, with Instagram, YouTube, and TikTok fueling content creation and monetization.

- The advertising segment emerged as the top revenue source in 2024, capturing 23.9% share, supported by brand collaborations, sponsored content, and influencer marketing campaigns.

(credit: market.us)

Europe Market Statistics

- The Europe Creator Economy Market is expected to grow from USD 14.3 billion in 2024 to USD 112.42 billion by 2034, expanding at a strong CAGR of 22.9% between 2025 and 2034.

- In 2024, the Videos segment led the market, securing more than 38.8% share, driven by rising demand for short-form and long-form video content.

- The Video Sharing segment also held a dominant position, capturing 23.7% share in 2024, with platforms like YouTube and TikTok fueling audience engagement.

- The Subscriptions segment emerged as a major revenue model in 2024, contributing a substantial share of the region’s creator earnings, supported by growing adoption of paid memberships and exclusive content.

(credit: market.us)

North America Market Statistics

- The North America Creator Economy Market is projected to grow from USD 55.8 Billion in 2024 to USD 331.4 Billion by 2034, advancing at a strong CAGR of 19.5% during 2025–2034.

- The U.S. Creator Economy Market is expected to expand from USD 50.9 Billion in 2024 to nearly USD 297.3 Billion by 2034, marking a robust CAGR of 19.3%.

- In 2024, Social Media Platforms dominated as the leading channel, holding 29%+ share, supported by broad user reach and monetization flexibility.

- By content format, Video Content led with 24%+ share in 2024, reflecting strong consumer preference for visual storytelling and high engagement rates.

- Brand Collaborations ranked as the top monetization channel, accounting for 22.7%+ revenue in 2024, boosted by increasing influencer-brand partnerships.

- Professional Creators were the largest end-user group in 2024, generating 63.3%+ of revenue, driven by higher content quality and stronger audience loyalty.

(credit: market.us)

APAC Creator Economy Market

- The APAC Creator Economy Market is forecast to expand from USD 41.6 Billion in 2024 to USD 390.7 Billion by 2034, registering a strong CAGR of 25.1%.

- China’s creator economy was valued at USD 16.7 Billion in 2024 and is projected to grow at a robust CAGR of 25.4%, reflecting its central role in APAC’s digital ecosystem.

- In 2024, Social Media Platforms dominated with a 28% share, driven by high user engagement and broad audience reach across mobile-first markets.

- Video Content led by content type, securing a 24% market share, supported by consumer preference for short-form and live-streaming formats.

- Brand Collaborations emerged as the leading monetization method, capturing 24.6% share, as brands increasingly leverage creators for authentic promotions.

- Professional Creators represented the largest end-user group, accounting for 65.2%, signaling a shift towards sustainable creator careers in the region.

(credit: market.us)

Total Content Creators worldwide

| Influencer level | Number of influencers | Follower count |

|---|---|---|

| Recreational | 23 million | 0-1K |

| Semi-Pro | 139 million | 1K-10K |

| Pro | 41 million | 10K-100K |

| Expert | 2 million | 100K-1M |

| Expert+ | 2 million | 1M+ |

(Source: Linktree)

Top Revenue Sources

| Rank | Creator Economy Main Revenue Source | Proportion |

|---|---|---|

| 1 | Brand deals | 68.8% |

| 2 | Ad share | 7.3% |

| 3 | Started own brand | 4.8% |

| 4 | Affiliate links | 4.6% |

| 5 | Courses | 4.4% |

| 6 | N/A (no income) | 3.7% |

| 7 | Tips | 3.5% |

| 8 | Other | 2.7% |

(source: explodingtopics.com)

Insights on Consumer Engagement

- 87% of consumers say content featuring personally relevant topics is key for engagement.

- 79% of consumers are inspired to explore brands after seeing an ad within creator content, and nearly 70% are motivated to discuss and share that brand with others.

- 76% of consumers report that creator content helps them see a product in action and visualize its usefulness in their lives.

- 75% of consumers say ads in creator content enhance product satisfaction.

AI and Its Influence on Trust

- 62% of content consumers are less likely to trust and engage with AI-generated content.

- 74% of content creators cite deepfakes as a major AI-related concern.

- 56% of creators report brand requests to use generative AI in content creation, but 40% expect brand fees will remain unchanged despite AI integration.

- 71% of creators using AI tools report positive follower reactions, with most applying them for photo and video backgrounds.

Challenges

- Only 46% of creators report finding success in today’s creator economy.

- 58% still struggle to monetize their work.

- Even among earners, 68% are unsatisfied with their income levels.

- 45% of aspiring creators cite lack of knowledge and time as their main barriers to entry.

- Nearly 43% highlight balancing creative work and monetization as a core challenge.

- 41% of creators face burnout, struggling to keep a consistent content schedule.

- Even at the top, 32% of high-performing creators worry about audience growth.

Key Players

Social Media/Video Sharing

- Instagram (US)

- BitClout (Japan)

- Cameo (US)

- Discord (US)

- Moonio (Spain)

- Pallyy (Australia)

- TikTok (China)

- Twitch (US)

- YouTube (US)

E-commerce/Marketplace

- Etsy (US)

- Gumroad (US)

- Impact (UK)

- OpenSea (US)

- Shopify (Canada)

- Stan (US)

- Teespring (US)

Subscription/Support

- Buy Me a Coffee (US)

- OnlyFans (UK)

- Patreon (US)

Content Creation/Distribution

- Acast (Sweden)

- Canva (Australia)

- ChatGPT (US)

- DALL-E (US)

- Gemini – formerly Bard (US)

- Ghost (US)

- Substack (US)

- TextFX (US)

- Thinkific (Canada)

- Writesonic (US)

- Spotify (Sweden)

Upscaling

- Beacons (US)

- Jellysmack (US)

- Komi (US)

- Later (Canada)

- Linktree (Australia)

- The Leap (US)

(Source: NeoReach, Slashdot, The Leap)

Conclusion

The creator economy has emerged as a structured global industry where creativity is directly linked to income generation. More than 200 million individuals worldwide now participate as creators, with platforms such as Instagram, YouTube, and TikTok serving as the primary enablers for content distribution, trend formation, and career building.

The demographic composition highlights important shifts in participation. Millennials currently represent the largest segment of creators, accounting for nearly 40% of the active base, yet younger generations are entering at a faster pace. Gen Z and even Gen Alpha are increasingly contributing to content production, supported by their digital-first lifestyles and early adoption of social media platforms.

Reference

- https://www.theleap.co/blog/creator-economy-statistics/

- https://grin.co/blog/understanding-the-creator-economy/

- https://www.aspire.io/blog/the-creator-economy

- https://learn.g2.com/creator-economy-statistics

- https://www.vdocipher.com/blog/creator-economy/

- https://inbeat.agency/blog/creator-economy-statistics

- https://www.uscreen.tv/blog/creator-economy-statistics/

- https://www.wpbeginner.com/research/creator-economy-statistics-that-will-blow-you-away/